Monzo has taken the financial world by storm, offering a modern and innovative approach to banking. With its cutting-edge technology and customer-centric services, Monzo is reshaping how people manage their finances. Whether you're looking for a user-friendly app, real-time transaction tracking, or budgeting tools, Monzo delivers an unparalleled experience.

Launched in 2015, Monzo has grown from a small startup to a global fintech giant. The company's mission is to make financial services accessible, transparent, and convenient for everyone. By leveraging the power of digital technology, Monzo aims to eliminate the complexities traditionally associated with banking.

In this comprehensive guide, we'll explore Monzo's features, benefits, and how it compares to traditional banks. We'll also examine its impact on personal finance management and discuss why it's becoming a preferred choice for millions of users worldwide. Let's dive into the world of Monzo and discover why it's revolutionizing the banking industry.

Read also:How Old Is Selena Gomezs Daughter Everything You Need To Know

Table of Contents

- Introduction to Monzo

- Key Features of Monzo

- Monzo vs Traditional Banks

- How Monzo Works

- Benefits of Using Monzo

- Monzo User Experience

- Costs and Fees

- Security and Privacy

- Monzo in the Global Market

- Conclusion

Introduction to Monzo

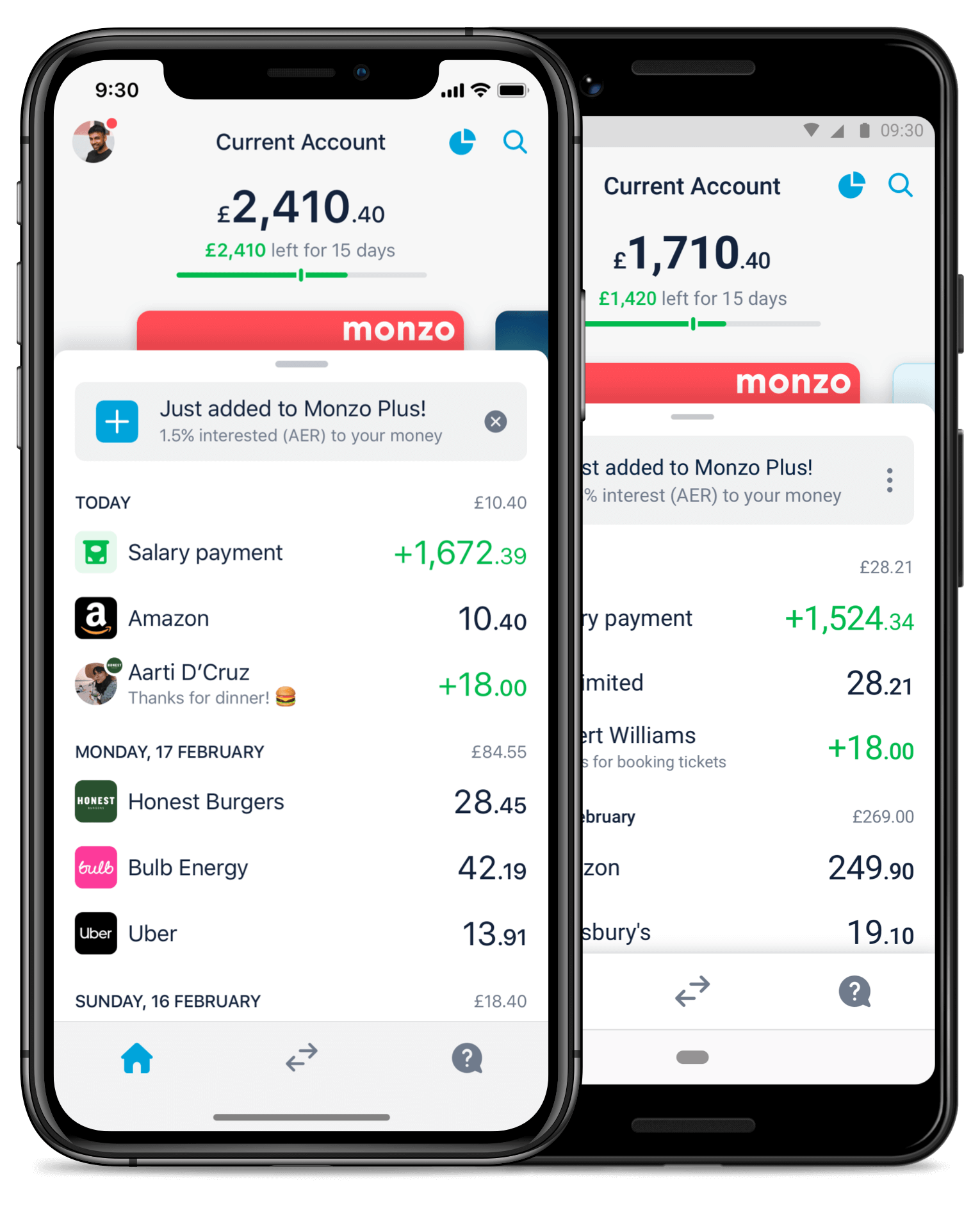

Monzo is a UK-based digital bank that operates entirely through a mobile app. Since its inception, Monzo has focused on providing a seamless banking experience by combining advanced technology with exceptional customer service. The platform allows users to manage their finances effortlessly, offering features such as instant transaction notifications, budgeting tools, and international payment capabilities.

Monzo's Vision and Mission

Monzo's vision is to create a banking experience that is simple, transparent, and accessible to all. The company aims to empower individuals to take control of their finances by offering tools and resources that promote financial literacy and responsibility. By eliminating unnecessary fees and hidden charges, Monzo strives to provide fair and transparent banking services.

Monzo's Journey So Far

Since its launch in 2015, Monzo has experienced exponential growth. The company has attracted millions of users across the UK and beyond, expanding its services to meet the evolving needs of its customers. Monzo's success can be attributed to its innovative approach, strong community engagement, and commitment to delivering value to its users.

Key Features of Monzo

Monzo offers a wide range of features designed to enhance the banking experience for its users. These features are tailored to meet the diverse needs of modern consumers, making Monzo a versatile and reliable financial partner.

Instant Transaction Notifications

One of Monzo's standout features is its ability to provide real-time transaction updates. Users receive instant notifications whenever they make a purchase or withdraw money, ensuring they are always aware of their spending activity.

Comprehensive Budgeting Tools

Monzo's budgeting tools help users track their expenses and manage their finances effectively. The app categorizes transactions automatically, making it easy to identify spending patterns and set financial goals.

Read also:Opa In Greek Meaning A Comprehensive Guide To Understanding And Using The Word

International Payment Support

Monzo supports international payments, allowing users to spend abroad without worrying about excessive fees or unfavorable exchange rates. This feature is particularly beneficial for travelers and those who frequently engage in cross-border transactions.

Monzo vs Traditional Banks

Monzo offers several advantages over traditional banks, making it an attractive option for tech-savvy consumers. Below are some key differences between Monzo and conventional banking institutions:

- Accessibility: Monzo operates entirely through a mobile app, eliminating the need for physical branches and providing 24/7 access to banking services.

- Transparency: Monzo charges no hidden fees and provides clear information about all costs associated with its services.

- Customer Service: Monzo prioritizes customer satisfaction, offering responsive support through its app and social media channels.

How Monzo Works

Using Monzo is straightforward and intuitive. Users can sign up for an account through the Monzo app, which is available on both iOS and Android platforms. Once registered, they receive a Monzo debit card, which can be used for in-store and online purchases. The app provides a comprehensive dashboard where users can monitor their account balance, view transaction history, and manage various settings.

Setting Up a Monzo Account

Creating a Monzo account involves a few simple steps:

- Download the Monzo app from the App Store or Google Play.

- Provide basic personal information and verify your identity.

- Link your existing bank account to fund your Monzo account.

- Receive your Monzo debit card in the mail and activate it through the app.

Managing Your Finances with Monzo

Monzo empowers users to take control of their finances by offering tools and features that promote financial responsibility. These include:

- Pocket feature for setting aside money for specific purposes.

- Bill management tools to help users stay on top of recurring payments.

- Investment options through Monzo's partnerships with trusted providers.

Benefits of Using Monzo

Monzo offers numerous benefits that make it a compelling choice for individuals seeking a modern banking solution. Some of these advantages include:

Convenience and Flexibility

Monzo's mobile-first approach ensures that users can access their accounts anytime, anywhere. Whether you're checking your balance, transferring funds, or paying bills, Monzo makes it easy to manage your finances on the go.

Cost-Effectiveness

Monzo eliminates many of the fees associated with traditional banking, such as ATM withdrawal charges and currency conversion fees. This makes it an economical option for users who value affordability.

Enhanced Security

Monzo employs advanced security measures to protect user data and prevent fraudulent activities. Features like PIN protection, card blocking, and transaction monitoring ensure that users' accounts remain secure at all times.

Monzo User Experience

Monzo's user-friendly interface and intuitive design contribute to a seamless user experience. The app's clean layout and straightforward navigation make it easy for users to perform various tasks without feeling overwhelmed.

User Feedback and Ratings

Monzo consistently receives positive feedback from its users, who appreciate its ease of use and reliable performance. Reviews on app stores and social media platforms highlight the app's functionality, speed, and customer support as standout features.

Community Engagement

Monzo fosters a strong sense of community among its users by encouraging feedback and collaboration. The company actively listens to user suggestions and implements improvements based on input from its community.

Costs and Fees

Monzo strives to keep costs low for its users, offering many services free of charge. However, certain transactions and features may incur fees. Below is a breakdown of Monzo's pricing structure:

- Account Maintenance: Monzo does not charge monthly fees for maintaining an account.

- ATM Withdrawals: Users can withdraw cash from ATMs in the UK without any charges. International withdrawals may incur fees depending on the user's plan.

- International Transactions: Monzo applies fair exchange rates for international purchases, with minimal fees for premium users.

Security and Privacy

Monzo places a high priority on security and privacy, implementing robust measures to safeguard user data. The company adheres to strict regulatory standards and employs encryption technology to protect sensitive information.

Data Protection

Monzo complies with GDPR regulations, ensuring that user data is handled in accordance with European privacy laws. Users have control over their data and can request deletion or exportation at any time.

Fraud Prevention

Monzo's fraud detection system monitors account activity for suspicious behavior and alerts users of potential threats. In the event of unauthorized transactions, Monzo offers protection and assistance in resolving the issue.

Monzo in the Global Market

Monzo's expansion into international markets reflects its ambition to become a global leader in digital banking. The company has already established a strong presence in the UK and is exploring opportunities in other regions to broaden its reach.

Challenges and Opportunities

While Monzo faces competition from other fintech companies and traditional banks, its innovative approach and customer-centric philosophy position it well for future growth. By continuing to innovate and adapt to changing market conditions, Monzo is poised to thrive in the global financial landscape.

Conclusion

Monzo has emerged as a trailblazer in the digital banking sector, offering a refreshing alternative to traditional banking services. Its commitment to transparency, accessibility, and security has earned it a loyal user base and a reputation as a leader in fintech innovation.

We encourage you to explore Monzo's offerings and discover how it can enhance your financial management experience. If you found this article helpful, please share it with others and consider leaving a comment below. For more insights into the world of finance and technology, be sure to check out our other articles on the site.